In most cases of DUI violation, your auto insurance premiums will rise, sometimes dramatically. You may end up spending as much as double the initial amount for premiums, if not more. A single case of DUI violation may increase auto insurance premiums by 72 percent on average. While this article sheds light on the financial ramifications of a DUI violation on car insurance rates, it’s also important to consider the broader legal landscape and how various charges can impact individuals’ lives. If you find yourself facing charges beyond traffic violations, the expertise of a specialized legal professional becomes invaluable. For instance, a prostitution defense lawyer in orlando fl can offer critical defense strategies and support for those navigating the complexities of such charges, highlighting the importance of specialized legal assistance across different areas.

A case of drunk driving offense will have a long-term impact on the insurance premiums, sometimes up to six years in some countries. If you’re looking for better insurance premiums overall, consider checking out Surex.

If you’ve been charged with DUI, you’ll almost always need an SR-22 form issued by a trusted insurance company to get your driving license back. Let’s look into dui lawyer in Brampton and how they affect your insurance rate after a violation.

DUI Regulations

As stated in a report conducted on April 29 by the CSC (Canada Safety Council), Canada’s blood alcohol regulation is very stringent as opposed to most other Western countries.

Driving with a blood alcohol content (BAC) of 0.08, or 80 milligrams of alcohol per 100 milliliters of blood, is illegal and punishable by law in Canada. Provincial or territorial traffic laws also apply to drunk drivers with lower blood alcohol concentrations.

Just four out of the 20 comparative countries surveyed in the CSC report have a blood alcohol concentration of 0.08 or more, whereas 16 have a BAC of 0.05 or less.

Activists for lowering the criminal threshold to 0.05 (where traffic laws now apply) argue that Canada is falling behind a global pattern by keeping the criminal level at 0.08. A closer examination reveals that this is not the case.

DUI Violation Penalties

DUI violation comes with various penalties depending on your region. In Wisconsin, penalties are generally harsher for DUIs than other offenses so drivers will need to hold their sr22 insurance Wisconsin if the state requires them. However, whichever area you belong to, DUI violation is a serious offense and punishable by law.

You can read more on how drunk driving is defined in Canadian law and what consequences offenders face in each province around the country here.

How Does DUI Violation Affect Car Insurance Rate

If a driver is found guilty and accused of DUI violation, he faces a higher risk because this will significantly increase his premium rates.

Your insurance provider will investigate your driving history and condition from the department of motor vehicles, so it is always advisable to notify your car insurance provider as soon as possible.

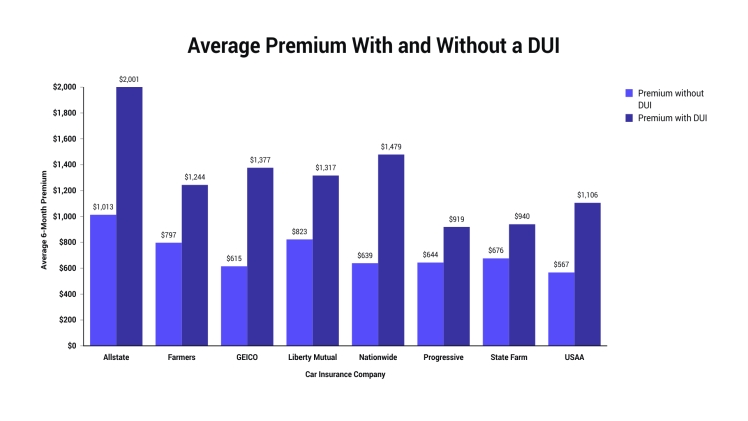

According to a premium study, DUI violation raises auto insurance costs by about $1,500 per year or more on average.

That’s an increase of 72% a year. In most countries, a one-time DUI violation can increase your rate twice its original amount, and a drunk driver who has been arrested up to four times may find it difficult to get licensed again.

Some other factors affect insurance rate after DUI violation, some of which are:

Time

The duration of time after your very recent DUI arrest also affects your premium.

When evaluating your driving history and calculating your DUI premium quote, insurance providers usually look at three or five years. You will need at least 36 months of clean driving history after DUI arrest before you apply for regular, lower prices in some regions.

Age

Most car insurance providers consider younger drivers to be highly risky to cover, and your age will play a significant part in how high your insurance rate rises after a violation.

The insurance rate on a 19-year-old who violated DUI during the last 12 months will cost more (about double or more) compared to the rate of a 35-year-old of the same record.

Number of DUI Violation

The amount of DUI violations a driver has in the last 3 years is a significant factor to consider.

Based on a survey, a 35-year-old with five DUIs should expect maximum insurance premiums of up to 200% more costly than those having one DUI violation.

FAQ About How Much Is Car Insurance After a DUI Violation

Here are a few frequently asked questions about DUI violations

How Will Insurance Providers Find Out About My DUI Violation?

An individual may be charged with a DUI violation with or without an accident. If there is no accident, the insurance provider might not get to know.

Your insurance provider will need to request a summary of your driving history from the appropriate ministry so as to know your non-accident associated DUI costs, which is usually done during the process of renewing your plan.

Does DUI Violation Affect My Insurance Rate in the First Place?

Unfortunately, the answer is YES. Most insurance providers in various countries will refuse to take a potential customer or renew a former one convicted of driving under the influence of alcohol.

Will My Name Be Displayed Publicly?

Sometimes, your state police may publicly decide to post your name, which is mainly done by posting the location, age, first name, and last name of the convict charged with DUI violation.

It is most likely that your insurance provider will be able to match the posted names with your details in their record even before the state police start releasing more details or making a deliberate effort to contact your car insurance providers.

How Do I Make My Insurance Provider Trust Me After DUI Violation?

Unfortunately, there is nothing you can do. All you need is to admit your fault and be patient.

Your DUI conviction will be on your insurance history for a minimum of three years, while the driving license restriction that comes with it will stay on your history for about six years. So you don’t have any choice but to wait.

Endnote

DUI violation is a serious offense which most insurance providers advise drivers to stay away from. However, if you have violated DUI regulations, it is expected that your insurance rate will increase significantly. We recommend visiting a trusted car insurance company to guide you if you find yourself in this situation.