Antigua and Barbuda, a sovereign island country in the West Indies, is increasingly becoming a magnet for foreign investors and businesspeople looking for efficient offshore banking solutions. At the heart of this financial allure is St. John’s, the capital and largest city of Antigua and Barbuda. Known for its favorable tax legislation and welcoming business environment, St. John’s offers a unique opportunity for foreigners to maximize their financial potential through offshore banking.

St. John’s: The Financial Heart of Antigua and Barbuda

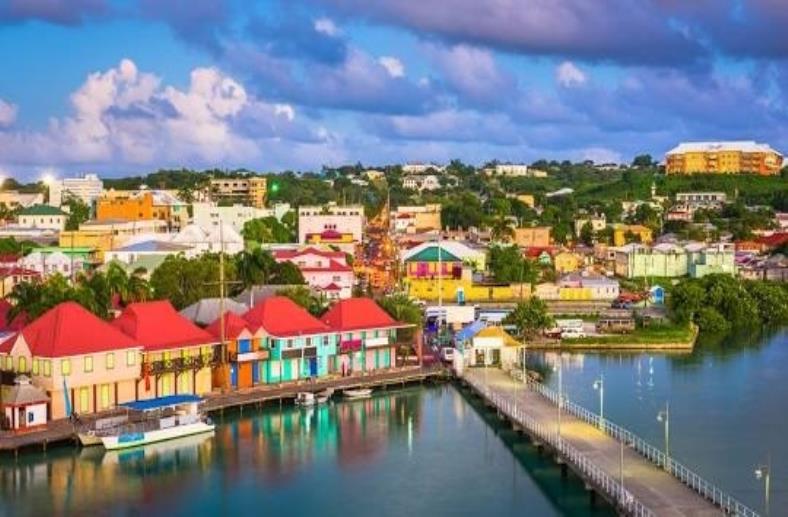

St. John’s stands as the bustling epicenter of Antigua and Barbuda’s economy. The city is not just a picturesque destination but also a thriving financial hub. It hosts a range of banks and financial institutions that cater extensively to international clients. This growing sector is underpinned by a stable political climate and a progressive approach to financial services, making St. John’s an attractive destination for offshore banking.

The city’s banks offer a variety of services that appeal to foreign investors, including multi-currency accounts, wealth management, and private banking. With a focus on confidentiality and efficiency, these institutions ensure that clients can manage their assets and conduct transactions with ease and security.

Banks in Antigua and Barbuda: An Overview

In St. John’s, several reputable banks offer offshore banking services. These include both local institutions and branches of international banks. Each bank has its own set of services, benefits, and fee structures.

Major Banks

- Eastern Caribbean Amalgamated Bank (ECAB): Known for its comprehensive offshore banking services.

- Antigua Commercial Bank (ACB): Offers a range of services including savings, checking, and investment accounts tailored for foreign clients.

- Global Bank of Commerce: Specializes in providing services to international business and investment clients.

Specialized Services

Antigua and Barbuda banks typically offer services such as online banking, international wire transfers, and investment options, all tailored to the needs of foreign investors and businesses looking to leverage the financial advantages of banking in Antigua.

How to Open a Bank Account in Antigua and Barbuda

- Choose a Bank: Research and select a bank that fits your financial needs and offers services beneficial for offshore banking.

- Gather Necessary Documentation: Typically, you will need a valid passport, proof of address (both local and in your home country), and a reference from your current bank. Additional documentation may include proof of income or business details.

- Complete the Application Process: Visit the bank in person or initiate the process online, if available. Submit the required documentation and fill out the necessary forms.

- Compliance Checks: Be prepared for compliance checks as banks adhere to international anti-money laundering regulations.

Conclusion

Offshore banking in St. John’s, Antigua, offers a unique blend of financial efficiency, confidentiality, and a business-friendly environment. With its strategic location and favorable tax legislation, St. John’s is a prime destination for foreigners looking to optimize their financial portfolios. By understanding the banking landscape and following the necessary steps to open an account, foreign investors and businesspeople can effectively utilize the financial opportunities available in this Caribbean haven.