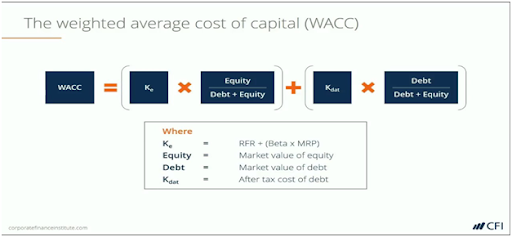

The idea of a limited income investigation is basic: we estimate the organization’s free incomes and afterward rebate them to the current worth utilizing the organization’s weighted-normal expense of capital (WACC). Computing WACC, in any case, can be somewhat more confounded. How about we investigate how it is finished? The weighted normal expense of capital or WACC Calculator the weighted normal value an organization should pay for obligation or value capital.

The equation for WACC= Cost of Debt * Debt/(Debt + Equity) plus Cost of Equity * Equity/(Debt + Equity)

The weightings of capital in this condition are not difficult to figure depending on the organization’s present monetary record. The expense of obligation is somewhat more included, yet lovely direct, however, the expense of value estimation can be troublesome.

Calculating Terminal Value:

Terminal worth can be two or three different ways – with an interminability computation or a leave various estimation. The ceaseless computation resembles a smaller than usual DCF investigation of the organization’s FCF off into boundlessness. The estimation of the ceaselessness esteem is as per the following:

Income in Terminal Year/(WACC – Long-Term Growth)

If we somehow happened to take the net present worth of an organization’s projected free incomes (FCF) five years out into the future, we would be downplaying the worth of the organization. We would leave out the worth of the organization’s projections over the past five years. To catch this worth, we need to compute the organization’s terminal worth (the worth of the organization in year five or the most recent year in a DCF examination).

Average Cost of Capital WACC, Historic Prices & Index Prices

The Weighted Average Cost of Capital (WACC) is a computation of an organization’s proportionately weighted capital as per explicit classifications. All wellsprings of capital – basic stock, favored stock, bonds, and some other obligations are incorporated. It’s figured by increasing the expense of every capital source by its relative weight (% of complete capital) and afterward working through this condition.

Cost of Capital WACC = (E/V) * Re Plus (D/V) * Rd * (1-Tc)

The WACC helps decide how an organization acquires its capital. Is it financing itself through obligation or value? The WACC helps answer that question. Processing WACC offers knowledge into an organization’s capacity to make returns upon its speculations and, thus, cash for financial backers. The WACC is frequently utilized by inside administration to control the organization toward helpful, money-making undertakings and away from losing ones.

Price-Earnings-Ratio Method

Pricing Earnings-Ratio (PER) is a basic and recognizable strategy for esteeming a stock among financial backers. Nonetheless, there are numerous alternative approaches to esteem a stock that can be very confounded and require a specialized aptitude. It’s difficult to say that anyone’s strategy is superior to other people. Thus, it’s normal for investigators to utilize a few valuation strategies and think of various reasonable qualities.

Monetary Value Added figures the genuine dollar measure of a business’ abundance made or annihilated in each detailing period. It accepts into account the open door cost (the base adequate pay for putting resources into a hazardous resource rather than a safer market instrument like government obligations) of the organization’s capital venture and measures the overabundance returns over this charge.